All Categories

Featured

Table of Contents

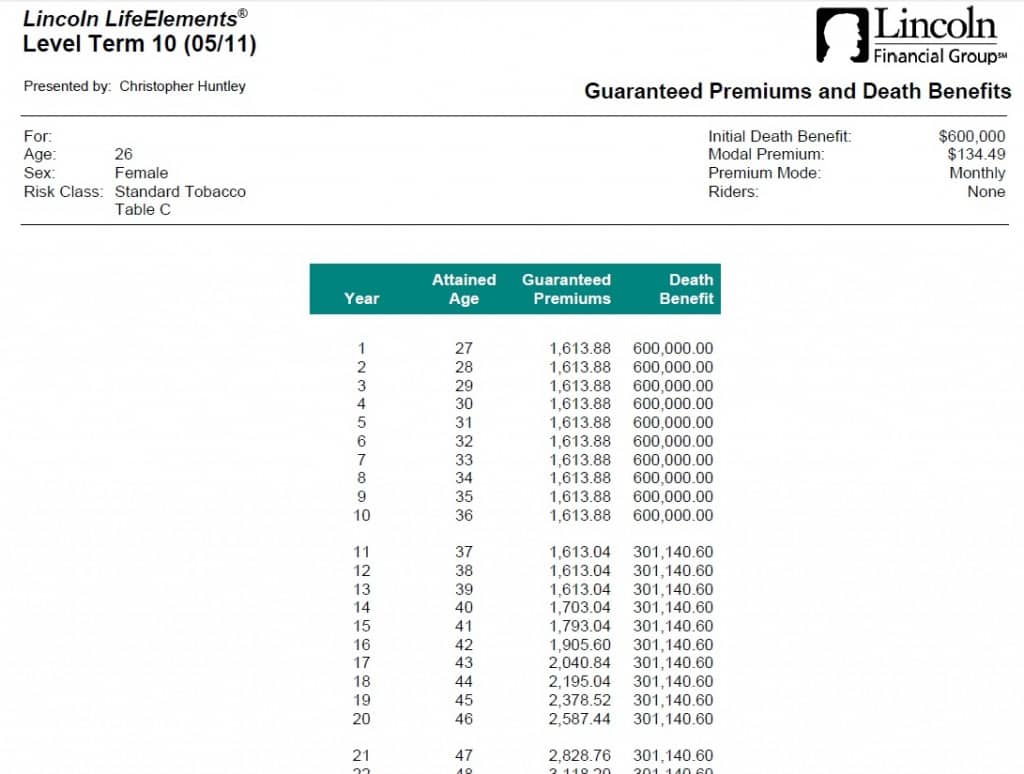

That commonly makes them a much more inexpensive choice for life insurance policy protection. Some term policies might not maintain the premium and fatality benefit the exact same in time. You don't wish to erroneously assume you're buying level term insurance coverage and afterwards have your survivor benefit change later on. Several people obtain life insurance policy coverage to help monetarily safeguard their loved ones in instance of their unanticipated death.

Or you may have the alternative to convert your existing term coverage right into a long-term policy that lasts the rest of your life. Different life insurance coverage plans have prospective advantages and downsides, so it is essential to recognize each prior to you make a decision to acquire a policy. There are several benefits of term life insurance coverage, making it a prominent option for insurance coverage.

As long as you pay the premium, your recipients will get the death benefit if you die while covered. That claimed, it's crucial to keep in mind that most plans are contestable for 2 years which implies coverage could be retracted on death, must a misstatement be located in the application. Plans that are not contestable frequently have actually a graded survivor benefit.

Costs are usually lower than whole life policies. You're not secured into an agreement for the remainder of your life.

And you can't squander your policy throughout its term, so you will not obtain any type of economic gain from your past insurance coverage. As with other kinds of life insurance, the cost of a level term plan relies on your age, protection requirements, employment, lifestyle and health. Typically, you'll locate a lot more economical coverage if you're younger, healthier and much less dangerous to insure.

Innovative Term Life Insurance With Accelerated Death Benefit

Because degree term costs stay the same for the period of insurance coverage, you'll know specifically how much you'll pay each time. Degree term protection additionally has some flexibility, allowing you to tailor your plan with extra functions.

You may have to meet particular conditions and qualifications for your insurance company to establish this motorcyclist. There likewise could be an age or time limitation on the coverage.

The death advantage is typically smaller sized, and coverage generally lasts until your kid transforms 18 or 25. This motorcyclist may be an extra cost-efficient method to help guarantee your kids are covered as riders can commonly cover numerous dependents at once. As soon as your child ages out of this insurance coverage, it might be possible to transform the rider right into a brand-new policy.

The most usual type of irreversible life insurance is entire life insurance coverage, however it has some vital differences compared to level term coverage. Below's a fundamental introduction of what to take into consideration when comparing term vs.

Quality Level Term Life Insurance Meaning

Whole life insurance lasts for life, while term coverage lasts insurance coverage a specific period. The costs for term life insurance are usually lower than whole life protection.

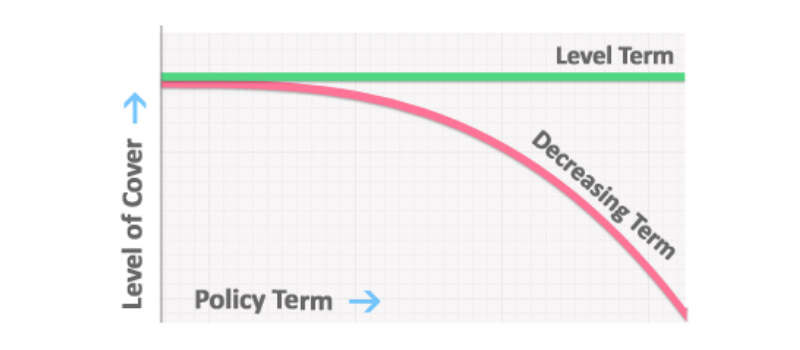

Among the highlights of level term protection is that your premiums and your survivor benefit do not transform. With lowering term life insurance policy, your premiums stay the same; nonetheless, the death benefit amount obtains smaller over time. You may have insurance coverage that begins with a death advantage of $10,000, which could cover a home loan, and after that each year, the fatality benefit will decrease by a collection quantity or percent.

Due to this, it's typically a much more cost effective kind of degree term protection., yet it might not be adequate life insurance policy for your requirements.

After deciding on a plan, finish the application. If you're accepted, authorize the documentation and pay your first premium.

Expert A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

Think about scheduling time each year to assess your plan. You may intend to upgrade your recipient info if you've had any kind of substantial life modifications, such as a marriage, birth or separation. Life insurance coverage can sometimes feel challenging. But you do not have to go it alone. As you explore your alternatives, think about discussing your needs, wants and interests in an economic professional.

No, level term life insurance policy doesn't have money worth. Some life insurance policy plans have an investment function that permits you to construct money value gradually. A portion of your costs payments is reserved and can make interest gradually, which expands tax-deferred throughout the life of your protection.

You have some choices if you still want some life insurance protection. You can: If you're 65 and your insurance coverage has actually run out, for example, you may desire to purchase a brand-new 10-year level term life insurance coverage policy.

Leading A Term Life Insurance Policy Matures

You may have the ability to transform your term coverage into an entire life plan that will certainly last for the rest of your life. Numerous types of level term policies are convertible. That means, at the end of your insurance coverage, you can convert some or all of your policy to entire life insurance coverage.

Degree term life insurance policy is a plan that lasts a collection term typically in between 10 and three decades and comes with a degree death advantage and degree costs that remain the very same for the whole time the plan holds. This indicates you'll know precisely how much your repayments are and when you'll need to make them, allowing you to budget appropriately.

Level term can be a wonderful option if you're looking to acquire life insurance policy protection for the first time. According to LIMRA's 2023 Insurance policy Barometer Study, 30% of all adults in the U.S. demand life insurance policy and don't have any type of kind of policy yet. Level term life is predictable and affordable, which makes it one of the most popular kinds of life insurance policy.

Latest Posts

Buy Final Expense Insurance Online

Funeral Coverage Insurance

Best Cremation Insurance